With so many loans obtainable, you may find it hard to locate the most effective mortgage. Often, the initial step would be to determine the right lender. Differing types of lenders are better for selected forms of financial loans. Every can assist you find the proper loan depending on your ambitions and circumstances.

If you already have fantastic credit, you can retain your credit rating by continuing to pay for all of your charges by the due date, protecting a credit utilization below 10%, keeping your oldest accounts open and only making use of For brand spanking new credit when required.

Through the use of more of one's credit you can raise your credit utilization ratio, which happens to be the second most crucial factor in calculating your FICO® Rating. To calculate your credit utilization, include up the total financial debt or balances on your credit cards, then incorporate up the credit limits on all your cards and divide the entire stability by the entire credit Restrict.

All Web-site interactions and mobile phone phone calls are recorded for marketing and advertising, compliance and quality assurance purposes. By closing this observe and utilizing this Web-site, you accept and agree to our Terms and Conditions and Privacy Coverage, including the provisions pertaining to accepting or averting cookies. X

Online lenders generally don’t offer companies like checking or discounts accounts, but simply because they concentrate on loans, they typically have speedier acceptance times and application procedures.

Receive and assessment the loan estimate and (if all appears good) digitally signal the personal loan disclosures to start the final approval system.

Possibility fees—Paying out off a mortgage early may not be excellent since mortgage charges are rather very low in comparison to other fiscal fees.

So, irrespective of whether pace is actually a top precedence or you desire an online lender that focuses on a niche—For illustration, for those who’re a first-time home customer—there’s a thing here for everyone.

Another reason your scores could be unique is as the creditor will possible pull 1 of one's credit experiences and not all 3 any time you submit an application for new credit, triggering a variance in the volume of difficult inquiries produced with your credit.

Closing Statement: A sort made more info use of at closing that provides an account of the funds been given and compensated at the closing, such as the escrow deposits fro taxes, hazard insurance, and mortgage insurance coverage.

Opportunity financial savings. Mainly because online-only lenders don’t have physical spots, they might normally pass the overhead Charge financial savings on to shoppers in the shape of lessen curiosity premiums or much less charges.

When a corporation checks your credit report any time you apply for new credit, for instance a credit card or simply a personal loan, the method is named a "tough inquiry." This credit Check out remains on the credit for 2 many years but has a short-expression influence.

For being regarded as for preapproval, you must fill out a mortgage software for lenders to run a hard credit Look at and provide most or all of these kind of supporting files:

Evaluation: A charge from a house for the goal of taxation. This might go ahead and take form of a levy much a Specific purpose or even a tax where the property owner pays a share in the price of Local community advancements according to the valuation of his or her house.

Daniel Stern Then & Now!

Daniel Stern Then & Now! Joseph Mazzello Then & Now!

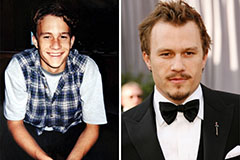

Joseph Mazzello Then & Now! Heath Ledger Then & Now!

Heath Ledger Then & Now! Danielle Fishel Then & Now!

Danielle Fishel Then & Now! Rossy de Palma Then & Now!

Rossy de Palma Then & Now!